Student interest is shifting to Asia and MENA. Here's what the data shows

For decades, international students followed the same path: US, UK, Canada, Australia. Everywhere else was an afterthought.

That’s changing.

New data from Studyportals, based on 51 million students searching for programmes, shows MENA and Asia are taking serious market share from traditional destinations. The shift comes down to what students actually care about: lower costs, flexible delivery, and programmes that lead to jobs.

MENA’s flexible delivery approach is showing results

The numbers prove it:

Between 2021 and 2023, interest in MENA transnational programmes hit nearly 6,000 monthly searches. MENA universities in global rankings grew 23.6% year-over-year in the 2026 QS rankings (the fastest growth rate of any region).

The Gulf is leading this transformation. UAE, Saudi Arabia, and Qatar are funding it heavily: scholarships, branch campuses, major TNE investments.

Saudi Arabia is seeing remarkable growth. Demand for Bachelor’s programmes jumped 68.1%, and Master’s demand grew 11.1%. This aligns with Vision 2030 reforms. At the city level, Jeddah saw extraordinary growth whilst Dhahran and Riyadh also grew substantially.

The UAE continues positioning itself as a TNE hub. Abu Dhabi saw demand rise 28.4% for Bachelor’s and 32.8% for Master’s programmes. The country is actively attracting international institutions through favourable visa reforms and global partnerships.

A focus on online programmes is working because it targets students that traditional campus-only models can’t easily serve: working professionals, students facing visa problems, cost-conscious learners who need quality without moving abroad.

And it’s not just online. MENA institutions are offering blended programmes, multiple delivery modes, and shorter courses alongside traditional degrees. More entry points for different student types means capturing more of the market.

Asia proves scale works

The numbers show the campus-based approach at scale:

- Over 20,000 English-taught programmes across 600+ ranked universities

- Master’s programmes make up 52.2% of what they offer, matching student demand (69% want Master’s)

- 30+ transnational branch campuses by 2025, up from 20 in 2019

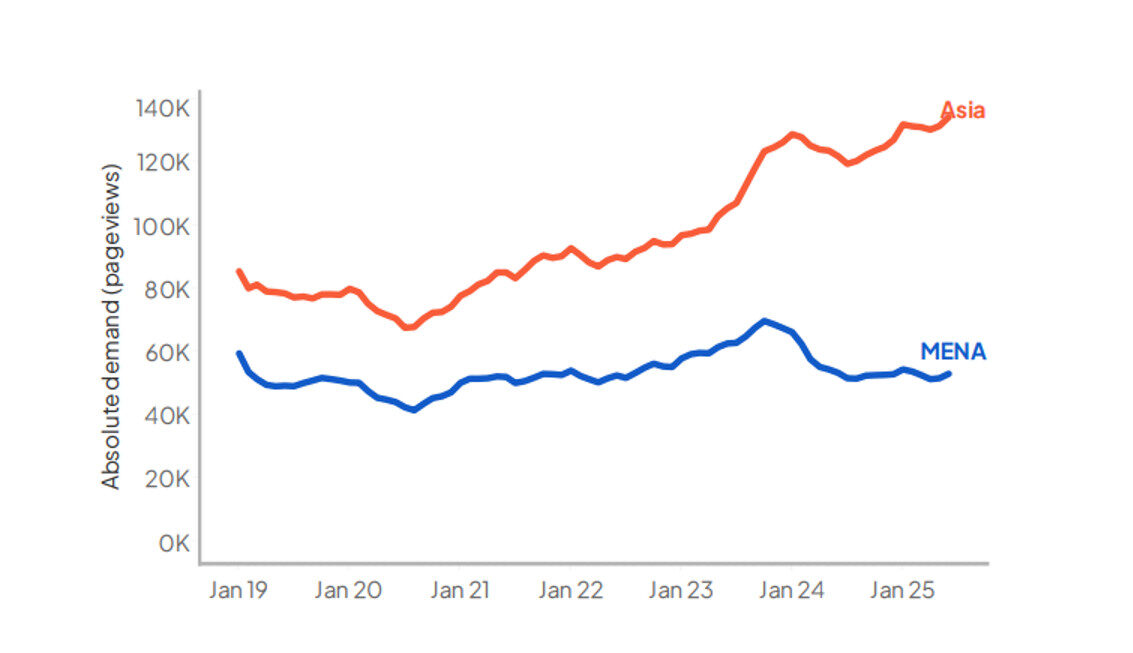

- Student interest keeps growing since 2021

China, Japan, Malaysia, and India anchor the region. Vietnam and Indonesia are rising fast with quality programmes at lower prices.

Asia figured out campus-based education at scale. They built what students want, got institutions into global rankings, and did it consistently. They have volume and brand recognition working for them.

What’s notable: Asia and MENA are serving different student groups. Asia’s campus-heavy model works for students who can move abroad. MENA’s flexible delivery captures students who need alternatives. Both approaches are growing the total market rather than competing for the same students.

What’s driving students towards MENA and Asia

Cost advantage is real

Master’s in US/UK: $50K-$100K total. Same degree from a MENA institution: $15K-$30K, often with scholarship support. This isn’t just competitive pricing, it’s opening education to students who couldn’t afford Western alternatives.

For regional students especially, keeping them closer to home at better prices keeps both talent and tuition revenue in-region.

The bigger picture

Global student mobility hit 6.9 million in 2023, up 176% since 2002. Still growing.

MENA is capturing more of it through flexible delivery and strategic investments. Asia is capturing more through campus scale and rankings. Both regions are proving there are multiple ways to compete for international students beyond the traditional model.

For institutions in UAE, Saudi Arabia, Qatar, and across MENA: the region is already leading in flexible delivery. The next phase is aligning programme portfolios with where student demand is actually growing, not where it was five years ago.

The data shows exactly where students are searching, what they’re looking for, and where the gaps are between demand and supply. That’s competitive intelligence you can act on.

Download the report to see country and city-level trends, supply-demand gaps and student demand data.