Leveraging the Asian decade in international education

Marcel Bandur

Marcel Bandur

Karl Baldacchino

Karl Baldacchino

Asia has long been recognised as a major source market for international students, but today, it is increasingly positioning itself as a leading study destination. As the region continues to gain economic prominence, the demand for higher education in Asia has surged, driven by the rise of world-class universities, affordability, and expanding English-taught programs.

Coupled with growing interest from students outside the region—attracted by Asia’s cultural influence, post-graduation opportunities, and government initiatives—these factors are reshaping global student mobility patterns. By analysing Studyportals data, this article explores the evolving demand for Asian study destinations, the disciplines experiencing the greatest shifts, and the broader implications for international education.

Destination Asia: Insights from Studyportals Data

It is unsurprising that prospective students often consider programmes in the traditional ‘Big Four’ study destinations—Australia, Canada, the UK, and the US—due to their established reputations and perceived advantages in the global job market. Similarly, Europe remains a key hub for international students, offering a blend of academic and practical education, cultural diversity, multilingual environments, and a high standard of living. These factors continue to shape the concept of the ‘student experience’ and influence mobility trends.

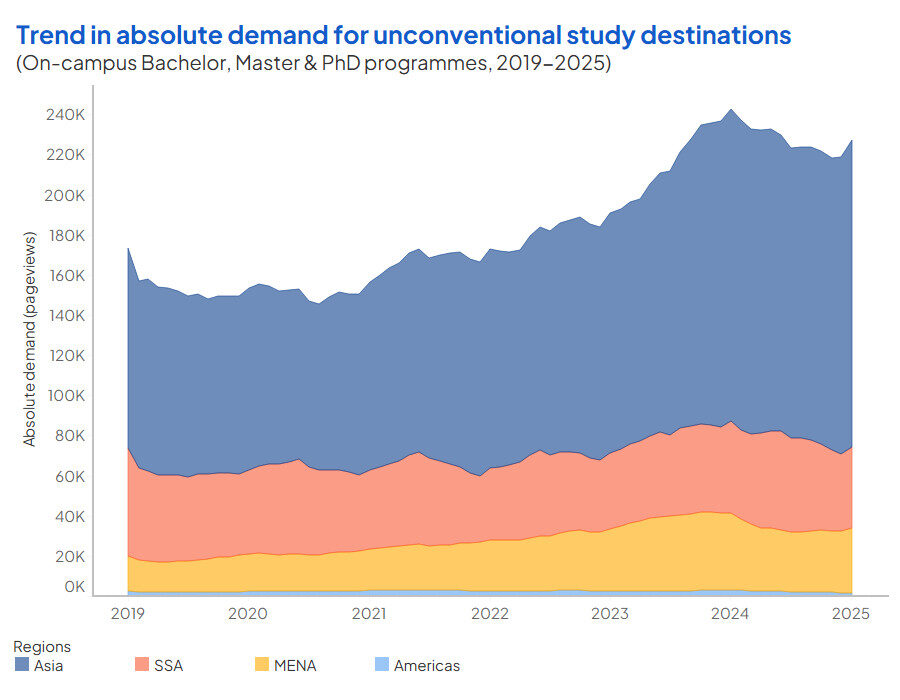

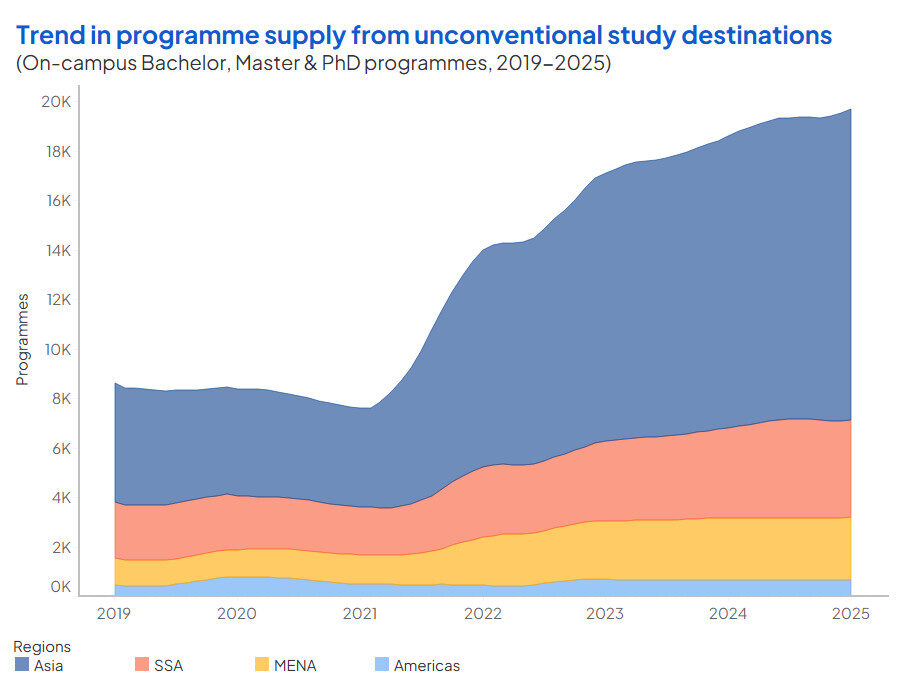

That being said, Studyportals data shows that beyond these destinations, absolute student demand (measured in pageviews) for Asia as a destination is quite significant . Asia has blossomed to become a strong competitor in providing a tertiary, English education to students. When compared to demand for other ‘non-traditional’ destinations such as in Sub-Saharan Africa (SSA) or the Middle-East & North Africa (MENA), this is even more striking.

The rising demand for university education in Asia stems from the excellent quality of Asian universities, coupled with their affordable tuition fees, and lower costs of living compared to their counterparts in the Big Four study destinations. 143 universities in Asia were added to the 2025 QS World University Rankings, with the Times Higher Education’s Asia University Rankings 2024 including 739 universities from Asia.

Then comes the question of affordability. In the past decade, the appetite for university education has grown in line with the expanding middle class population in some of the largest Asian and African countries. While education is widely seen as a gateway to better career prospects, affordability has become a crucial consideration. Asian study destinations, such as Malaysia, India, and China, are capitalising on these demographic and mindset shifts.

Significantly, Asia has, and remains to be, the largest source market of international students, with India and China in the lead. Young Asians no longer need to cross seas to find excellent universities as the proximity of world-leading universities closer to home now plays a significant role. More Asians are choosing their tertiary education within the region, and this, in turn, brings funding and resources that are crucial in the betterment of university facilities and value offering. The increase in student demand from outside of Asia is then a natural consequence, further driven by the growing appeal of Asia’s pop culture and culinary scene to international students

Today, the world’s economic center of gravity is firmly planted in Asia. As we’re well within the Asian decade, economic opportunities are shifting East. Post-study job opportunities are undoubtedly a strong driver of student demand. In this regard. Asia is increasingly popular, with many government schemes seeking to retain foreign talent to offset their rapidly ageing population, such as in Japan and South Korea.

Another key driver of the rising demand for higher education in Asia is the expanding availability of English-taught programmes. Initially, programmme growth appeared to mirror student demand, but institutions have since accelerated the expansion of their offerings. The Studyportals dataset reflects both organic growth in programme supply and Studyportals’ efforts to identify and catalogue these programmes. However, notable increases in supply may also stem from national strategies aimed at boosting Asia’s competitiveness in international education such as from the likes of Taiwan, South Korea, and especially Malaysia. To understand the full state of the market for English-taught programmes globally, download and view the report done by British Council and Studyportals.

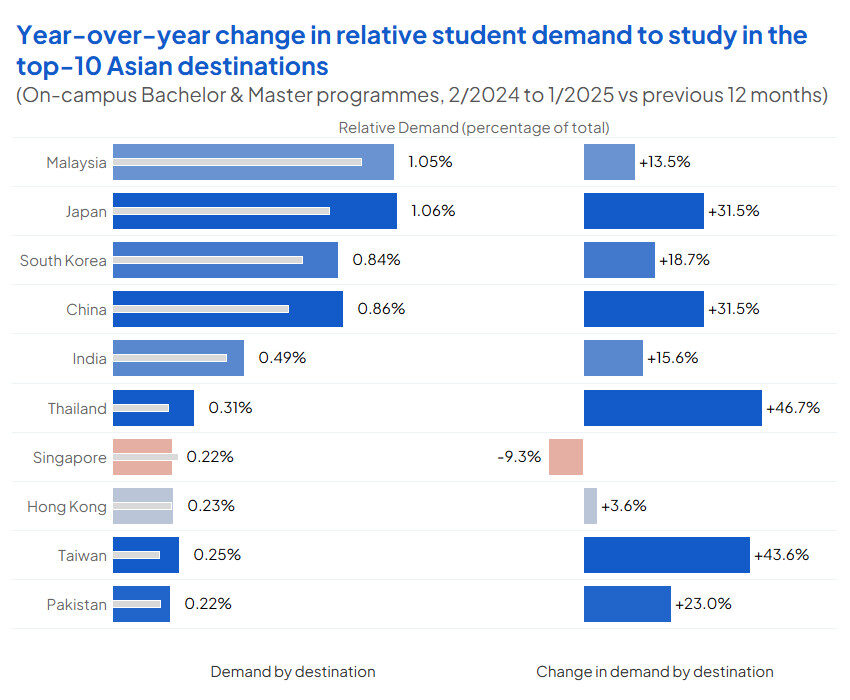

Focusing then on Asian study destinations, the visual below further confirms how relative demand (share of total pageviews) for the region has largely grown in the last 12 months (02/2024 to 01/2025) compared to the previous 12 months (02/2023 to 01/2024). This is especially true for destinations in East Asia (Japan, China, and Taiwan) but also for South and South-East Asia (India, Pakistan, Malaysia, and Thailand). The only exception to this is the modest decline in demand for Singapore, potentially influenced by rising living costs stricter post-study work policies for foreign talent, and an overall competitive job market that can be challenging for international students to navigate.

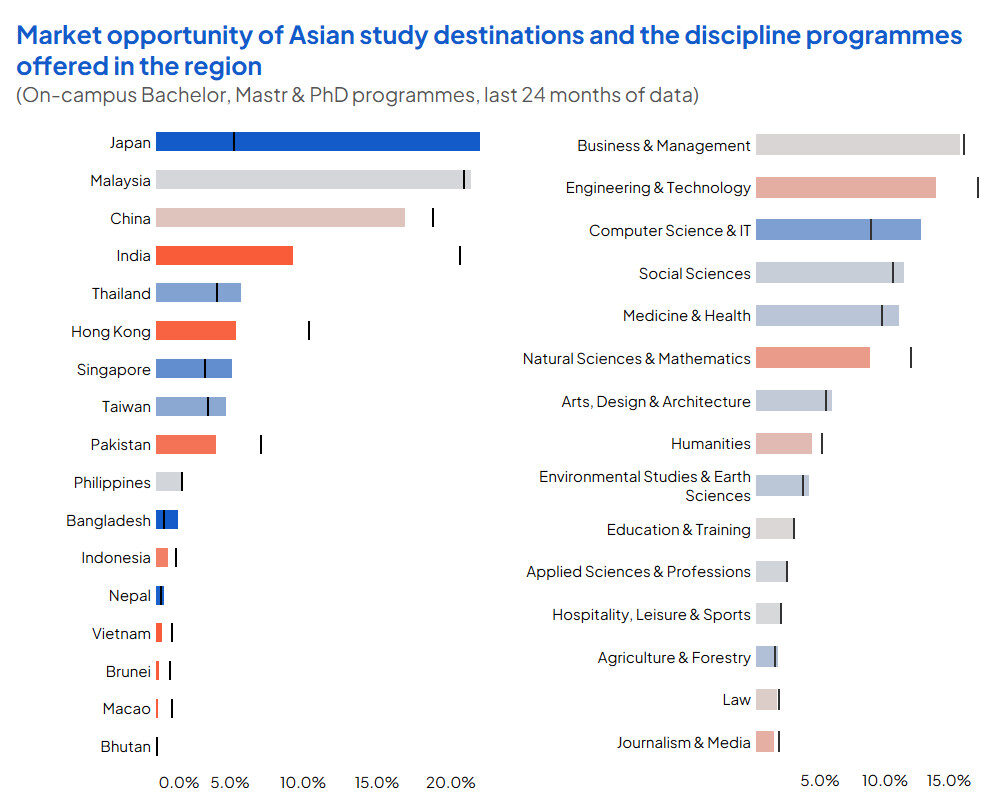

However, when looking at the market opportunity for Asia, Singapore is one of the few study destinations that can afford to expand the number of Bachelor, Master, and PhD offers available to students.

The Market Opportunity is the percentage of interest for programmes in a destination (across all the destinations) divided by percentage of programme supply (across programmes) worldwide. Some destinations have more student demand than the volume of programmes that they supply which may suggest that there is room for more studies to be made available. Conversely, it is also the case that a destination’s supply exceeds students demand, indicating an oversaturated market.

The relative demand captured by Singapore, indicated by the blue coloured bar, exceeds the relative supply of programmes offered across the region, represented by the vertical black lines. In addition to this, Japan also stands out as the destination where institutions can afford to expand their English-taught portfolio to meet the interest of prospective students.

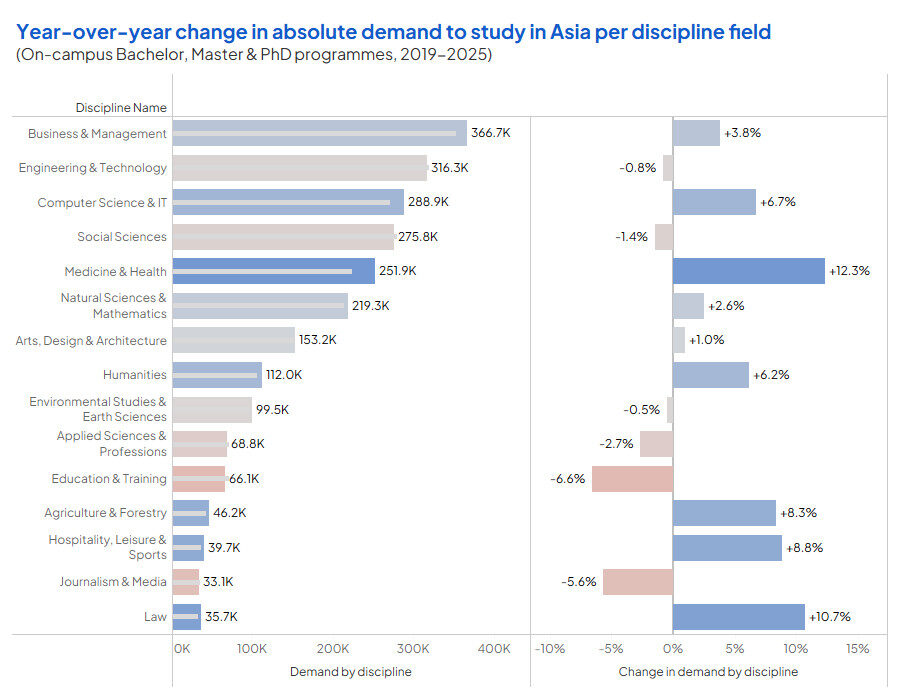

Focusing on discipline fields, another key indicator of Asia’s growing appeal to international students is the overall increase in absolute demand across most subject areas over the past 12 months. This trend is particularly notable for Bachelor’s, Master’s, and PhD programs in Medicine & Health (+12.3%), which reflects the increasing global focus on healthcare careers and Asia’s expanding investment in medical research and facilities. Similarly, demand for Law (+10.7%) and Hospitality (+8.8%) has risen, likely driven by the region’s strengthening of its legal and tourism sectors, as well as its positioning as a global business and travel hub. Agriculture (+8.3%) has also experienced steady growth, reflecting Asia’s role in food security and AgriTech innovation, while Computer Science (+6.7%) benefits from the region’s prominence in AI, digital industries, and tech innovation.

Conversely, demand for Education (-6.6%) and Journalism (-5.6%) has declined slightly, which may be linked to shifting student priorities toward high-growth STEM-related fields, as well as digital disruption affecting traditional media careers. Meanwhile, Applied Sciences (-2.7%) have seen only a modest decline, suggesting that while demand remains stable, students may be gravitating toward more specialised or interdisciplinary STEM programs. Despite these fluctuations, Asia’s higher education landscape continues to evolve, with emerging opportunities shaping student mobility patterns across disciplines.

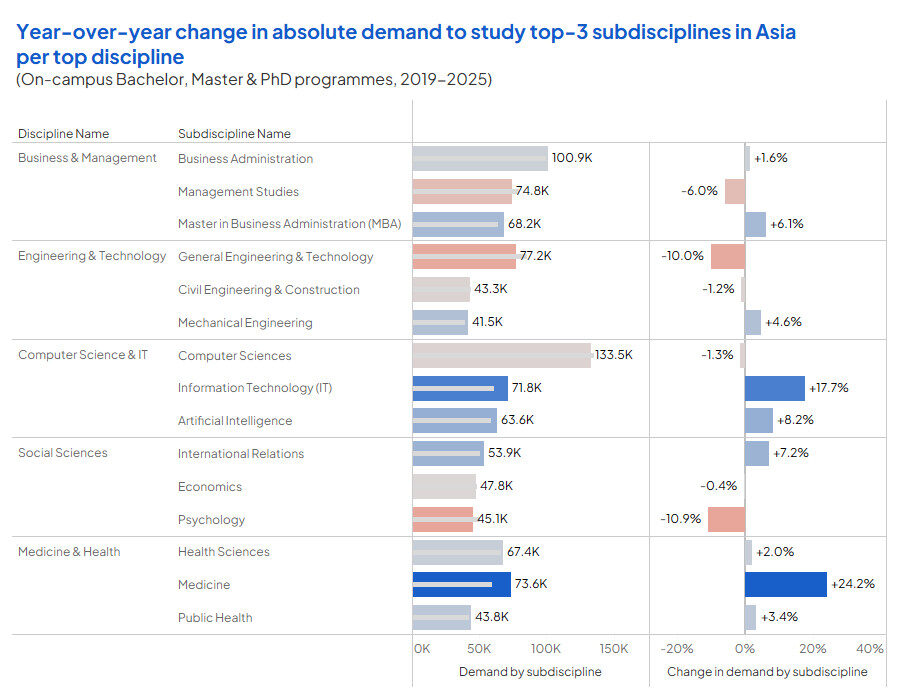

Lastly, when examining the top five discipline fields by student demand, it is also important to consider how their subdisciplines are performing when offered in Asia. While some subfields mirror the overall growth trends—such as Business Administration, Health Sciences, and Public Health—others, including Civil Engineering, Computer Sciences, and Economics, have shown a slight decline. These shifts may reflect changing student preferences or evolving industry needs within Asia’s education landscape.

At the same time, fields such as Medicine, Information Technology, Artificial Intelligence, International Relations, MBAs, and Mechanical Engineering continue to attract strong interest. The sustained demand for these areas suggests that students are seeking qualifications aligned with technological innovation, global affairs, and business leadership.

In contrast, Psychology, General Engineering, and, to a lesser extent, Management Studies have seen a more noticeable decline. This may indicate a relative slowdown in interest for broader or less specialised degrees, with students increasingly opting for programmes that offer clearer career pathways or emerging sector relevance. These patterns highlight the dynamic nature of student demand in Asia, where both regional and global factors continue to shape educational choices.

A significant shift in global higher education

The rise of Asia as a preferred study destination marks a significant shift in global higher education. As institutions across the region continue to expand their programme offerings and enhance their global competitiveness, understanding these trends is crucial for universities, policymakers, and industry stakeholders. Whether it’s the growing appeal of certain disciplines, the impact of affordability, or the evolving role of post-study opportunities, Asia’s influence on international student mobility is only set to strengthen.

For a deeper dive into these insights and to engage in discussions on the future of higher education in Asia, we invite you to join Marcel Bandur, Senior Business Developer at Studyportals, Megan Agnew, Global Partnerships Manager at British Council, and Novie Tajuddin, CEO of Official Education Malaysia Global Services, at APAIE 2025. Their session, ‘Leveraging the Asian Decade in International Education’, will explore the key trends shaping student demand and provide valuable perspectives on how institutions can navigate and capitalise on Asia’s growing role in global education.

If you’re interested in tailored analytics and consulting services to better understand student mobility trends and market opportunities, reach out to the Studyportals Analytics and Consulting team. Our expertise in student demand analysis and market intelligence can help you make data-driven decisions in an increasingly competitive education landscape.