The African student surge: 64 million new students by 2034

Karl Baldacchino

Karl Baldacchino

Damaris Clark

Damaris Clark

Africa is a continent rich in potential—economically and demographically. Among its greatest assets is a growing population of talented students whose ambitions often outpace the capacity of domestic tertiary education systems. Many local institutions are unable to meet the rising demand for higher education, leaving a significant pool of potential untapped.

As a result, more African students are choosing to pursue their studies abroad. This trend is not only fostering global cultural and socio-economic links but also enriching classrooms around the world with fresh, diverse perspectives. These students contribute to academic discourse, ensuring that a wider array of narratives and lived experiences are represented.

Against this backdrop, this article explores the current landscape of international student recruitment in Africa. Drawing on Studyportals data and economic indicators from Oxford Economics, we examine key trends in student mobility, preferred study destinations, and subject area preferences to better understand the forces shaping Africa’s global education footprint.

International mobility according to student demand

Africa comprises 54 countries with a broad landscape of student markets, each characterised by distinct demographic trends, economic capacities, and educational policies. This applies to international student which varies not only in scale but also in trajectory as certain markets exhibit growth in outbound mobility, while others reflect more moderate or declining trends. In this context, relative demand is credible measure to understand the share of global student interest generated by a given country. This provides a proportionate measure of how much demand each origin contributes to the total volume of international student interest worldwide.

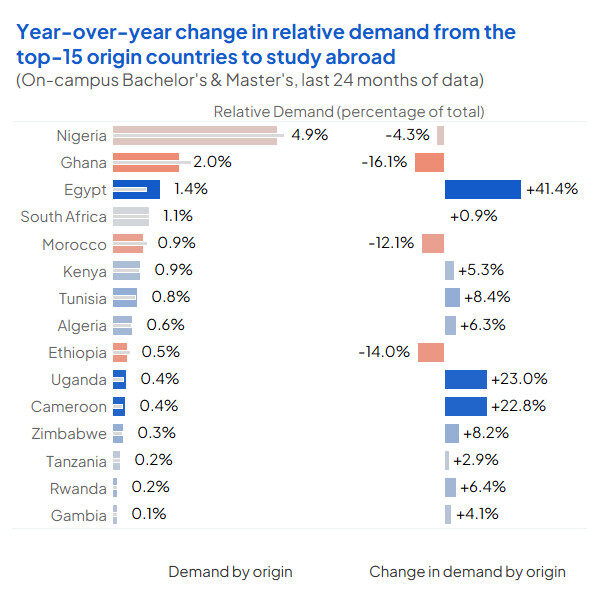

According to Studyportals data, prospective students based in Nigeria generated the highest relative demand for international study among all African countries to study an on-campus Bachelor’s or Master’s abroad, followed by Ghana. However, when comparing data from the most recent 12-month period (June 2024 to May 2025) with the preceding year (June 2023 to May 2024), relative demand from both countries declined—by 4.3% for Nigeria and 16.1%for Ghana.

In contrast, smaller markets in terms of overall volume displayed significant growth in their share of global demand. Notably, Egypt grew its share by 41.4%, while Uganda and Cameroon grew theirs by 23.0% and 22.8%, respectively. These shifts suggest an evolving landscape in which emerging markets are playing an increasingly important role in Africa’s international student mobility trends.

Understanding how international student interest evolves over time is essential for institutions and policymakers aiming to align their strategies with real-time market trends. One of the most actionable metrics for this purpose is the year-over-year change in relative student demand—which helps identify where interest is growing or declining and where recruitment opportunities may be emerging or contracting.

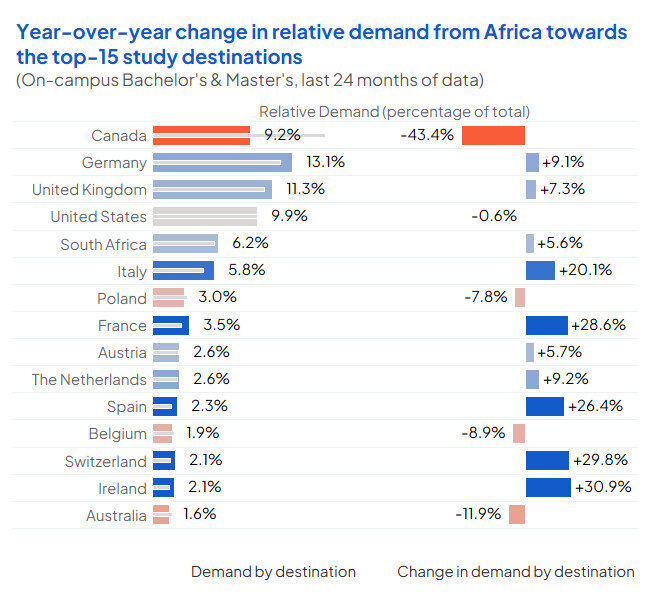

Over the past 12 months (June 2024 to May 2025), African student demand has notably shifted across top study destinations. While Canada was the leading destination by share of total African demand, it has seen a significant 43.4% decline compared to the previous year (June 2023 to May 2024). This sharp downturn suggests a cooling of interest that may be linked to changes in Canada’s visa policies and academic placements, in turn affecting perceptions of access.

At the same time, a number of European destinations have experienced a strong upward trend in relative demand from Africa. Ireland recorded a 30.9% increase, followed by Switzerland (+29.8%), France (+28.6%), Spain (+26.4%), and Italy (+20.1%). These growth rates indicate rising visibility and competitiveness of these destinations among African students, and potentially signal shifting preferences toward countries offering better affordability, post-study pathways, or sector-specific strengths.

Such year-over-year demand changes help institutions and governments monitor the relative success of recruitment strategies and programme relevance. Rising demand in particular markets presents a compelling signal for investment, while steep declines warrant deeper evaluation and strategic adjustments.

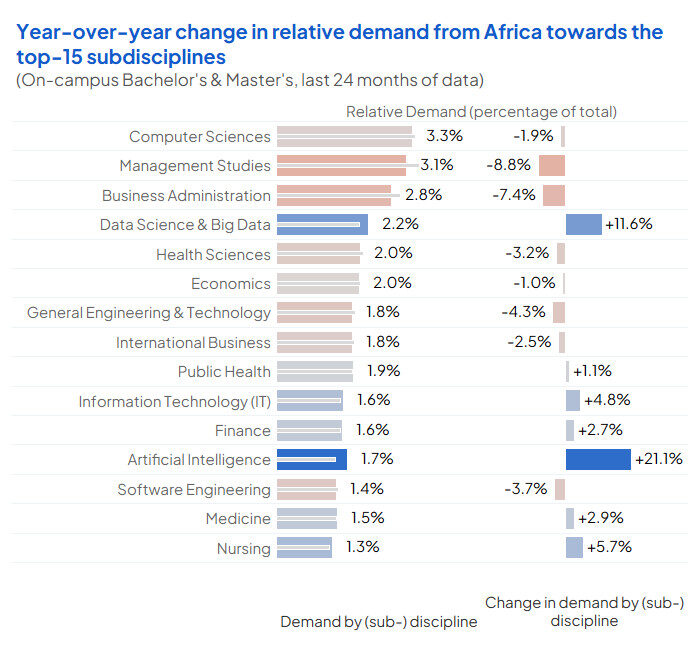

Changes in African student interest are also visible at the subject level. Some traditionally dominant fields have experienced modest declines in relative demand. For instance, Management Studies is down 8.8%, and Business Administration has declined by 7.4%compared to the previous 12 months.

In contrast, technology fields critical to labour market employers are gaining traction. Artificial Intelligence saw a 21.1% increase in relative demand, while Data Science & Big Data rose by 11.6%. These shifts reflect broader global trends toward digital and tech-driven careers, and highlight the increasing importance of future-proof academic offerings. For institutions aiming to attract more African students, aligning programme portfolios with high-growth areas like AI, cybersecurity, and analytics could be a high-impact move.

Shifts in demographic and economic capabilities

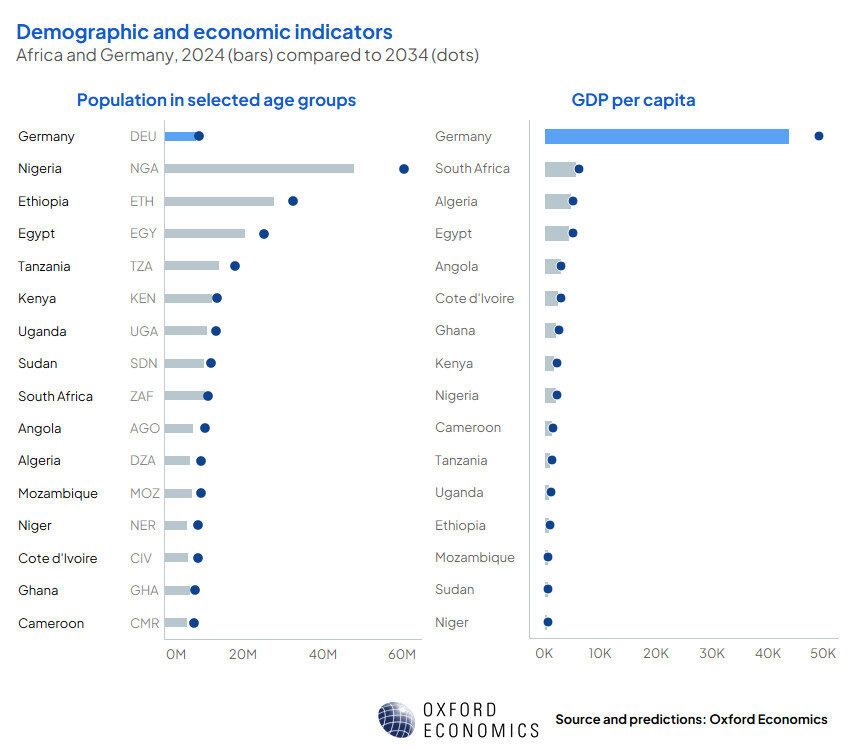

According to Oxford Economics data, Africa’s population of tertiary-aged individuals (15–24 years old) is projected to grow modestly in relative terms—from 18.9% to 19.1% of the total population between 2024 and 2034. Though this may appear to be a minor shift, in absolute terms it represents a substantial increase of approximately 64.5 million individuals—from 265.1 million in 2024 to 329.6 million by 2034. This demographic expansion will be most pronounced in countries such as Nigeria, Ethiopia, Egypt, Tanzania, Kenya, and Uganda.

Alongside this demographic growth, GDP per capita is projected to rise across many of these countries, reflecting broader improvements in being able to afford studying abroad. More directly linked to household-level well-being, however, is the metric of average household income, which further indicates families’ financial capacity to support higher education. Based on Oxford Economics projections, the number of households in Africa earning an average of approximately $35,000 USD annually is expected to grow by 48.4%, rising from around 5,133 households in 2024 to roughly 7,619 by 2034. (Note: Figures are in nominal USD and are not adjusted for purchasing power parity unless otherwise specified.)

Together, these demographic and economic indicators point to a future in which not only is Africa’s student population expanding in size, but also gaining greater financial capacity to participate in international education—offering compelling opportunities for institutions looking to engage with emerging markets.

Key takeaways

- The continent contains many markets, each with distinct trends in outbound student demand. Some markets like Nigeria and Ghana are stabilising or declining, while others such as Egypt, Uganda, and Cameroon are emerging with rapidly growing relative demand.

- While traditional source markets still contribute the most volume, several smaller countries are increasing their share of global demand—indicating untapped potential and the need for nuanced recruitment strategies.

- Projections from Oxford Economics highlights how Africa’s tertiary-aged population is set to rise by over 64 million by 2034, alongside rising household incomes and GDP per capita—indicating a growing, youthful, and increasingly economically capable student base.

Conclusion

Africa presents not only a fast-growing and dynamic recruitment market for international higher education institutions but also a deeper opportunity to engage with the continent’s rising generation of thinkers, leaders, and innovators. As Studyportals and Oxford Economics data show, demographic expansion and economic improvements are aligning to make international education increasingly accessible to African students across multiple markets and subject areas.

However, the significance of engaging with African students extends beyond enrolment metrics. These students contribute a diversity of perspectives, cultural richness, and lived experiences that can transform classrooms, contribute to campus narratives, and strengthen the global relevance of higher education. For institutions aiming to foster inclusive excellence, Africa is not just a region of opportunity—it is a partner in shaping the future of global education and development.