The future of student mobility runs through Southeast Asia

Southeast Asian students have been studying abroad for decades. But preferences are changing. Can traditional study destinations keep up?

Southeast Asia is a priority region for the international education sector. And for good reason. Home to around 700 million people and a growing middle-class eager for high-value services such as education, the region is projected to become the world’s fourth-largest economy, after the United States, China and India. This makes it a critical market for student mobility and transnational education.

For institutions looking to attract international students, the opportunities are enormous. Yet recent data paints a mixed picture, with demand patterns shifting significantly in recent years. Responding to these trends and student preferences will be essential for success.

A long history of international mobility

Southeast Asian students have been studying abroad for decades, including in Australia and New Zealand since the 1950s after the Colombo Plan paved the way for hundreds of thousands of students from the region to study overseas. With large youth populations, such as in Indonesia and in the Philippines, demand is set to grow further as more young people seek educational opportunities internationally.

International destinations step up recruitment in Southeast Asia

Recognising Southeast Asia’s potential, both traditional and emerging education destinations are taking concrete steps to attract more students from the region.

In August 2025, the Australian Government announced additional places to public universities to recruit students from ASEAN nations, aiming to diversify source markets and deepen regional engagement. New Zealand’s International Education Going for Growth plan targets a 42% increase in international enrolments, with a particular focus on Vietnam. Japan is also actively courting students from the region, and many European nations are looking to attract talent from Southeast Asia as well.

In this hyper-competitive environment, understanding prospective student preferences is critical. So, what do search patterns from the region reveal?

A region of shifting demand

Student preferences across Southeast Asia are evolving rapidly, and the data reveals a nuanced picture.

The region is emerging as an education hub, with new foreign institutions increasingly establishing transitional campuses. From established offerings like Monash’s Malaysia campus, which was the first foreign university campus in Malaysia, to more recent ventures like the Deakin University Lancaster University Indonesia campus, which was the first UK-Australia joint international campus, institutions are clearly looking to Southeast Asia as TNE opportunity.

The uncomfortable truth: traditional markets are losing ground while other countries gain momentum

Despite the opportunity and investment, recent trends present challenges for traditional education destinations.

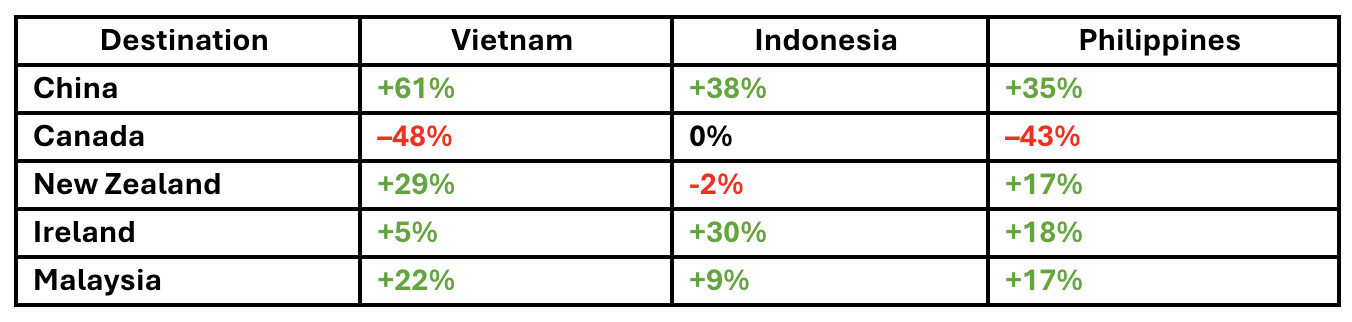

When we look at Studyportals global demand data from the top six Southeast Asian countries (Indonesia, Vietnam, Malaysia, Philippines, Singapore and Thailand) we notice some noteworthy shifts:

- China has seen large increases in demand from Vietnam and also from Indonesia and the Philippines

- Demand for Canada has plummeted, down 48% out of Vietnam and 43% from the Philippines

- New Zealand is attracting students who may have looked to Australia previously, with increases from Vietnam and the Philippines.

- Ireland has also seen increases out of these major Southeast Asian markets

- Demand to study within the region in the TNE hub of Malaysia has also increased

Meanwhile, the region’s economic growth is creating entirely new skills demands

Adding another layer of complexity, the types of skills Southeast Asia needs are rapidly evolving. Rapid technological change and the clean energy transition are intensifying demand for skilled graduates. Indonesia aims to add 57 million skilled workers by 2030, and the World Economic Forum highlights digital skills, climate adaptation, trade infrastructure, and environmental stewardship as critical across the region. Demand trends reflect the priorities of the region, with growth in diverse sub-disciplines areas including:

- Artificial Intelligence

- Biotechnology

- Food Technology

- International Relations

- Supply Chain Management

- Sustainable Development.

The opportunity for Australia and New Zealand

Fast-growing economies and new education hubs in Asia and Europe offering competitive programmes, often at a lower cost and with attractive post-study work conditions, mean traditional destinations are no longer automatic first choices.

To remain competitive, institutions must sharpen their value proposition, showcasing academic strengths, graduate employability, and the long-term ROI of study. Investing in emerging disciplines aligned with future skill needs and tailoring strategies to each Southeast Asian market will be crucial. Institutions should also monitor competitor strengths and communicate clearly the distinct advantages of their offerings.

Specifically for Australia and New Zealand, institutions have a unique opportunity to leverage their geographic proximity to South East Asia.

The big question: Who will capitalise on this opportunity, and who will let it slip away?

The opportunity in Southeast Asia is clear—but the question is whether the right conditions will be created to fully realise it. Governments and educational providers have prioritised the region in higher education strategies, and must now align action with the evolving needs of Southeast Asian students to compete and lead on the global stage.